Photo via City of Kamloops

In a bid to provide a bit of relief to taxpayers who are facing a nearly 11 per cent property tax increase, the City of Kamloops could cut its 2024 contribution to the climate action levy in half.

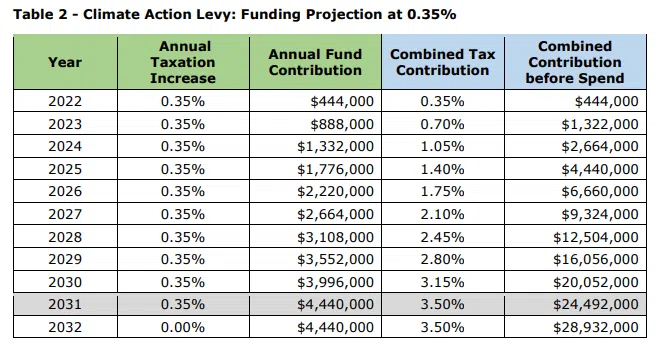

The City originally approved the taxation-funded levy as part of its 2022 supplemental budget. It adds an extra $444,000 a year towards the Community Climate Action Plan until at least 2031, at which point the annual contribution is expected to be $4.4-million.

“The funds generated through the Climate Action Levy will be distributed to various programs and project owners based on their priority in the Community Climate Action Plan and then moving down through the rankings until all the items are funded and operationalized,” a business case for the Climate Action Levy proposal said.

“Consideration will also be given to opportunities to leverage external funding sources such as grants, etc.”

Photo via City of Kamloops

At Tuesday’s Committee of the Whole meeting, council voted 5-3 to cut the 2024 contribution of $444,000 in half, with Councillors Nancy Bepple, Dale Bass, and Stephen Karpuk opposed. Councillor Kelly Hall was not present at the meeting.

The vote means the City is poised to collect $1.1-million in climate levies in 2024, instead of the estimated $1.3-million.

“To date about just under $700,000 has been used towards a number of active transportation projects, with the most substantial being contributions to complete the Sahali multi-use path,” Climate and Sustainability Manager Glen Cheetham said Tuesday, noting there was $632,500 sitting in the levy’s reserve as of Dec. 31, 2023.

“The intent with remaining is to build it up so that we have the ability to invest in other major infrastructure improvements, and potentially leverage it for grant funding.”

Councillor Katie Neustaeter says while she is in favour of the projects being funded by the levy, she wasn’t sure if it was the city’s highest priority at this time.

“This is not a normal year, and we have to find some kind of relief to provide our local tax base this year,” Neustaeter said. “So deferring these dollars, I don’t think is going to change climate action at this moment globally, so I am not in favour of the status quo, because its not a status quo year.”

Councillor Mike O’Reilly also said while council could argue about “the dollars and cents,” he said what taxpayers want to know is how much of a percentage increase they’re looking at when it comes to their property tax bills.

“That is what they’re going to hear on the headlines,” O’Reilly said. “That is what this is going to hopefully reflect and represent that we are doing everything that we can around here while still being very prudent and making sure that we are taking care of our assets and investing in our city.”

While City Council agreed to focus the Climate Action Levy towards the Active Transportation network, they did not commit to the original $444,000 increase in 2025. They’re expected to make that decision during budget discussions next year.

City Council also voted 6-2 in favour of halving this year’s contribution to the Asset Management Reserve fund from 0.5 per cent, or an extra $620,000 a year to 0.25 per cent, or an extra $310,000 this year.

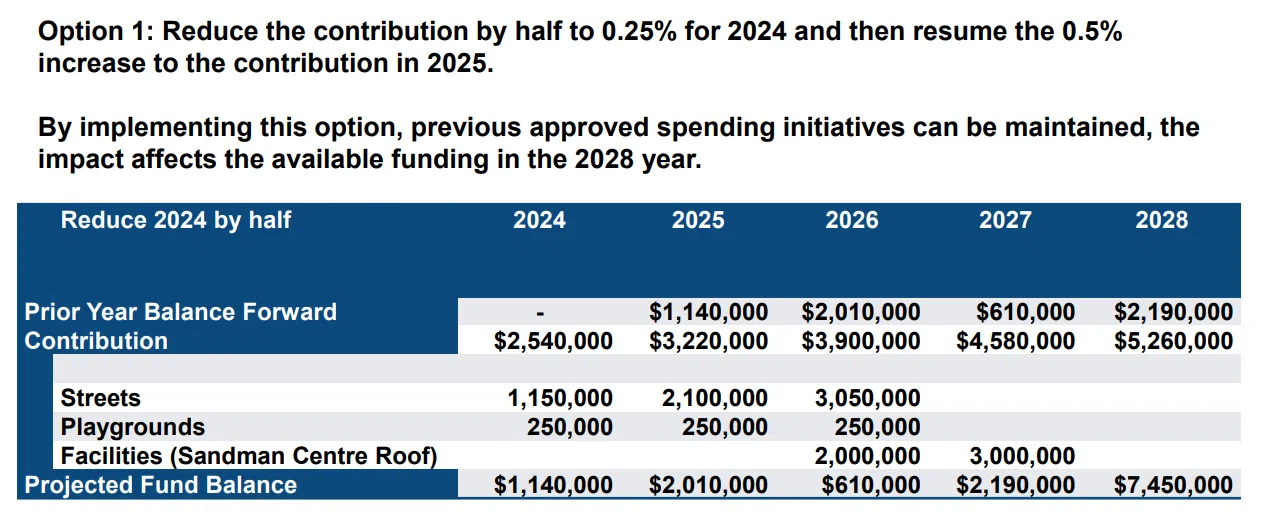

Councillors Bass and Bepple were opposed to that cut, with money in that reserve intended to go towards the ongoing care and management of civic assets in Kamloops, including streets and playgrounds, as well as a replacement roof for the Sandman Centre in 2027.

“Under this scenario, the same program deliverables can be maintained and done,” Corporate Service Director David Hallinan said Tuesday. “The $6 million into streets and streets restoration will be completed, along with the playground and the placeholder for Sandman Centre roof will still be intact.”

“[It will leave] approximately $7.5 million available again for 2028 to be allocated against a program to be discussed with council.”

Photo via City of Kamloops

Kamloops City Council will make a final decision on two cuts – which amount to a 0.425 per cent reduction in the overall property tax bill, or about $10.65 for the average Kamloops home, valued at $700,000 – next month.

“These are not the only items that we are looking at in terms of what we are presenting to council,” Hallinan told Radio NL. “We’re still going through the budget, we’re looking at whole bunch of different initiatives and a number of items both on the revenue side and cost side that are still continuing to play out at this point in time

Council will set the final tax rate in the spring, with property taxes typically due in early July.

For more on the 2024 City of Kamloops budget, go here.