Artist rendering of Canary Lofts/via canarylofts.ca

After a sluggish first half of the year marked by economic uncertainty and trade tension, Kamloops construction activity is starting to gain traction.

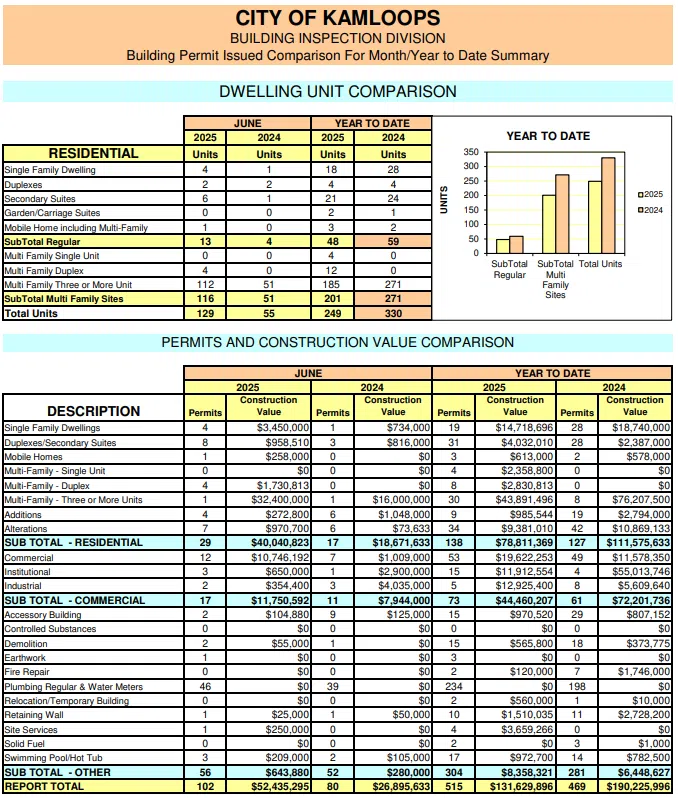

According to the City of Kamloops, 102 building permits were issued in June 2025, with a combined construction value of just over $52.4 million — nearly double the $26.9 million value recorded in June 2024, when 80 permits were issued.

Jason Dixon, the city’s Building and Engineering Development Manager, says the first half of the year was noticeably slower, though no one single cause stands out. “First off, it’s definitely been a slower start to the year than we saw in 2024. I wouldn’t be able to pinpoint some specific reasons. I think anybody who’s watched the news probably has a sense of the general economic uncertainty out there, and I would imagine that really just affects people both on the building side as well as people looking to purchase or move,” said Dixon.

Through the first six months of 2025, Kamloops issued 515 permits worth $131.6 million, compared to 469 permits worth $190.2 million during the same period in 2024. Dixon says the comparison is skewed by the presence of major projects last year — such as the $40 million Pineview Elementary School permit issued in April 2024 — that have not yet been matched in 2025.

However, a single permit issued this June significantly boosted monthly totals: an eight-storey, $32 million phase of the Canary Lofts at First Avenue and Columbia Street (Pictured). “We did, in June, have one big permit that was issued, and that’s for one of the next phases of Canary Lofts up at the top of First Avenue on Columbia Street. So $30 million in construction value in that one project. So that really helped what seemed like a really, really slow start to 2025. It kind of brought the numbers up a bit,” Dixon said.

Other categories also saw growth. Residential permits led the charge with 29 issued in June totaling $40 million, compared to 17 permits valued at $18.7 million in June 2024. While single-family dwellings increased slightly — four permits in June worth $3.45 million versus just one last year — Dixon says the long-term trend continues to favour higher-density housing.

“I haven’t seen a significant shift in the single family side of projects. We have seen sort of anecdotally over the last number of years, single family hasn’t been the driver in construction value. If you go back 10 years more, single family dwellings were absolutely the bread and butter of the construction industry, and there just hasn’t been as much demand. So, I think it has a lot to do with affordability, and we’ve seen over the last number of years much more activity in those more compact housing types, and I think we’re going to continue to see that going forward,” said Dixon.

The city also saw an uptick in commercial permit value, with 12 permits totaling $10.7 million issued in June — a major jump from just $1 million in commercial permits last June.

Looking ahead, Dixon says city staff are working with developers on several larger multifamily projects that could be permitted before the end of the year. “We’re working on permits for other bigger projects, so I’m hoping that as we get into the second half of 2025, we’ll issue some more permits for apartment-type buildings. I don’t have anything big on the horizon, like, a school or some big institutional or commercial building, but we do have some more significant multi-family projects that I’m hoping we’ll see the permits go out the door before the end of the year,” he said.

While the first half of the year has lagged behind 2024, Dixon believes the tide may be turning. “That’s what we would hope. June this year, compared to June last year, was quite a bit better. I think it just demonstrates the variability that we can see month to month. So, you can identify trends as you look, but every month has kind of got to be taken on its own merits and the projects that were issued permits in those months. So, I’m hopeful that June is an indicator that the back half of the year will see more activity than the first half of the year,” he said.

Still, Dixon is quick to keep expectations grounded as 2025 unfolds. “I think it doesn’t seem like anything out of the ordinary, other than just being a little bit slower start than what we normally see,” he added. “Definitely slower than last year, but I think, if memory serves correctly, when we got to the end of 2024, it was one of the bigger years we’ve ever seen in construction value. Not a record, but definitely up there in the top three or four, so we are comparing 2025 to a particularly strong year last year.”