British Columbia’s latest fiscal update is painting a bleak picture for the province’s bottom line, projecting a record-setting $11.6 billion deficit for the 2025-26 fiscal year — a figure that’s $665 million higher than anticipated in Budget 2025.

The numbers come amid persistent global trade uncertainty, declining revenues, and the province’s recent decision to eliminate the carbon tax on fuels — a move the government says was aimed at helping families cope with rising costs.

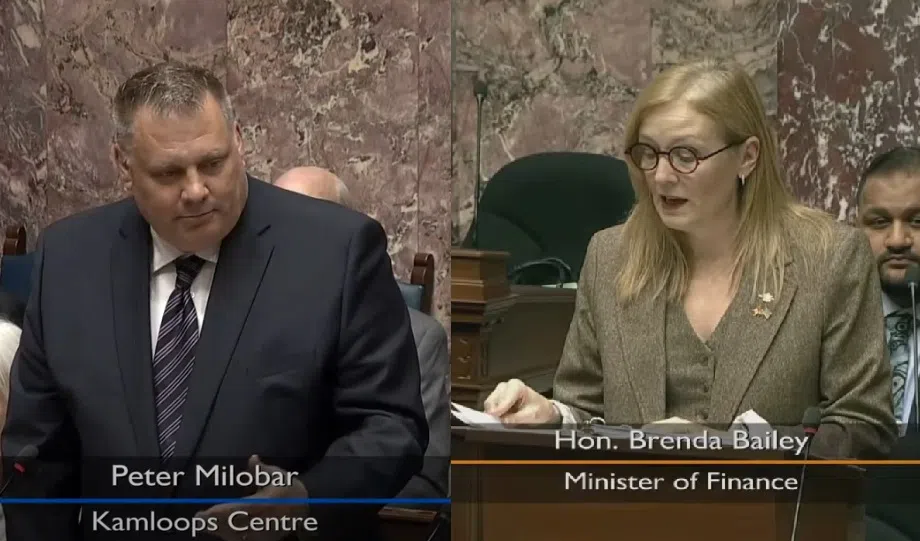

Finance Minister Brenda Bailey acknowledged the challenges in Monday’s First Quarterly Report, but emphasized that B.C.’s diversified economy and access to global markets will help weather the storm. “There’s no doubt that tariffs are challenging our economy and there is pressure on our fiscal position,” Bailey said. “We’re being focused with our spending, making smart reductions where we can… and protecting the services we all depend on now, and for the future.”

But critics — including Kamloops Centre MLA Peter Milobar, the BC Conservative Party’s finance critic — say the government has failed to present a credible plan to rein in spending or grow the private sector economy. “This government keeps saying they’re on a path to a balanced budget, yet can’t demonstrate that,” Milobar said. “They’re projecting even higher deficits in the years ahead. That should concern every British Columbian.”

Indeed, the fiscal outlook worsens over the medium term, with deficits forecast to rise to $12.6 billion in 2026-27 and $12.3 billion in 2027-28. The province’s overall debt is expected to climb to more than $212 billion by 2028, up from $155 billion today.

While Bailey pointed to increases in corporate income tax revenue and B.C.’s share of a historic $32.5 billion tobacco lawsuit settlement as partial offsets, Milobar was quick to criticize the government’s handling of that windfall. “It’s a lump sum bookkeeping trick,” he said, referring to the inclusion of B.C.’s tobacco settlement share in a single fiscal year, despite payments stretching over nearly two decades.

CFIB: “Wake-up Call” for Fiscal Discipline

The Canadian Federation of Independent Business also weighed in, calling the growing deficit a “wake-up call” for the provincial government. “Small business owners are tightening their belts and making hard choices every day. They expect government to show the same restraint,” said Ryan Mitton, CFIB’s B.C. director of legislative affairs.

According to CFIB research, B.C. small businesses pay roughly 20% more in taxes than their counterparts in Washington State, and 71% cite taxes and regulatory costs as their biggest operational challenge. “Tax hikes are not the solution,” Mitton added. “We need a credible plan to balance the budget through economic growth, not more fees.”

Calls for Economic Action in Kamloops and Beyond

In Kamloops, concerns are growing around how the province’s fiscal policies are impacting sectors like forestry, manufacturing, and small business. Milobar argued that B.C.’s regulatory environment is stifling competitiveness — particularly in resource-based industries. “Our forest industry is the least competitive and most expensive jurisdiction to operate in North America,” Milobar said. “This government has no real plan to support job creators or attract investment.”

He also urged the government to focus on finding efficiencies in the public service, suggesting even a 2% reduction in bureaucratic costs could save taxpayers $2 billion annually. “We’re not talking about cuts to health care or education,” he said. “We’re talking about smart fiscal management.”

Economic Outlook: Slower Now, Recovery Later

B.C.’s economy is still expected to recover over the medium term, thanks to stable employment, LNG exports, and increased residential construction. However, GDP growth has been revised downward to 1.5% in 2025 (from 1.8%) and 1.3% in 2026 (from 1.9%).

The province is still committed to its $1.5-billion expenditure management target over three years, with $300 million in savings already identified this year. “We’re reviewing every dollar to make sure it’s serving British Columbians,” said Bailey. “We’re building a stable economic future, while protecting key services people count on.”

As the 2026 budget planning begins, both critics and small business advocates are urging the province to chart a clearer course — one that supports growth without increasing the burden on households and entrepreneurs.